Optimizing Your Portfolio With Changenow’s Bitcoin To Litecoin Ratio

Swapping Bitcoin to Litecoin through ChangeNow exhibits remarkable efficiency in the cryptocurrency world. The platform, available at https://changenow.io/, simplifies the conversion process, ensuring a smooth and rapid transition between these two prominent digital assets. ChangeNow’s efficiency lies in its user-friendly interface, enabling effortless Bitcoin to Litecoin swaps. The simplified process involves entering the Bitcoin amount, selecting Litecoin, and completing the transaction swiftly. Direct user connections, advanced technology, and security measures ensure a seamless and protected environment for asset transactions.

Advantages of Diversification:

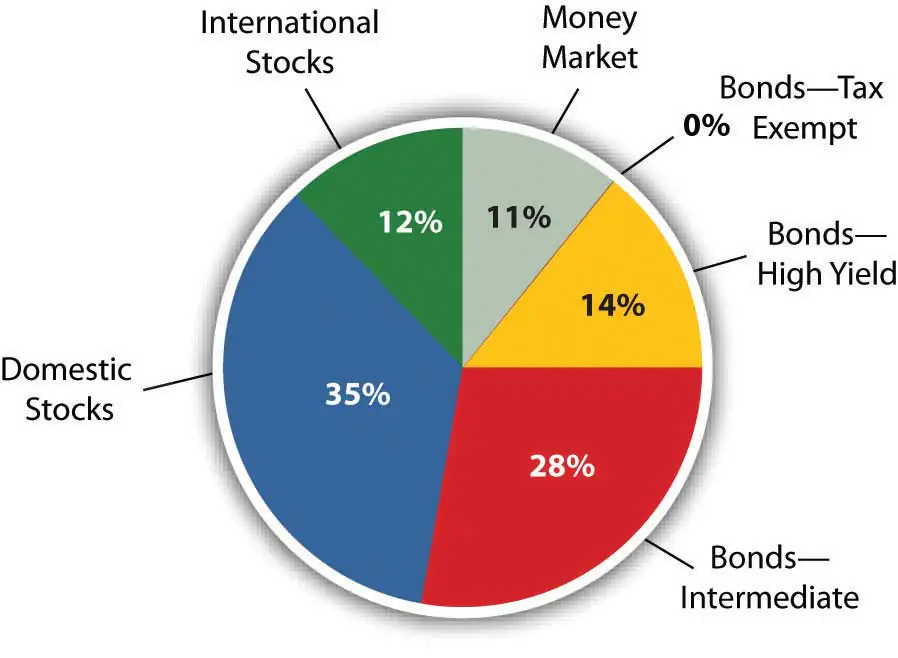

Diversification offers significant advantages, foremost among them being risk mitigation. By spreading investments across various assets like stocks, bonds, and cryptocurrencies, investors reduce the impact of poor-performing assets on the overall portfolio. Diverse assets respond differently to market conditions, providing a buffer against downturns. This risk reduction is crucial in volatile markets, offering protection against potential losses.

Another key benefit is the potential for enhanced returns. Diversification allows investors to capitalize on opportunities in different sectors or markets, balancing the impact of market fluctuations for more consistent long-term returns.

Additionally, diversification enhances liquidity, enabling quick adjustments in unforeseen circumstances, and supporting disciplined, long-term investment strategies.

Reduced Transaction Costs:

Reducing transaction costs is crucial for enhanced investment returns, encompassing fees related to financial instrument transactions. Diversification lowers trade frequency, promoting a stable, long-term approach that mitigates short-term market impact. Utilizing low-cost index funds or ETFs in diversification contributes to overall cost reduction compared to actively managed funds.

Diversification refines tax costs through strategic planning, minimizing capital gains taxes. Efficient capital utilization balances risk for long-term returns.

Market Insights for Decision-Making:

A well-diversified portfolio provides essential market insights, guiding investor decisions and offering a comprehensive view of market dynamics. Diversification’s impact is evident in exposure to various sectors, revealing economic indicators, and influencing decisions based on sector-specific trends.

Diversified portfolios include varied risk-return profiles, with defensive sectors countering declines and growth-oriented assets thriving in expansions. International diversification navigates global trends, providing real-time feedback for data-driven decisions aligned with financial goals.

Security Measures in Crypto Exchanges:

Security is paramount in cryptocurrency exchanges, and diversification strategically bolsters the safety of digital assets amid inherent market risks like hacking and fraud. Implementing stringent security measures and diversifying investments across platforms create a fortified protection layer. Given the frequent targeting of exchanges by malicious actors, diversification minimizes the risk of a single point of failure.

Additionally, using hardware wallets and cold storage in a diversified crypto portfolio enhances security, reducing exposure to online threats. Diversification allows strategic allocation based on the security features of exchanges, prioritizing safety. Diversifying cryptocurrencies mitigates adverse events’ impact on a specific coin, aligning with a resilient and secure investment approach.

Comparing Bitcoin and Litecoin Performance:

Maximizing a cryptocurrency portfolio requires meticulous evaluation of individual asset performance, emphasizing a strategic comparison between Bitcoin and Litecoin. While Bitcoin, renowned as digital gold, holds prominence as a store of value, Litecoin, often referred to as silver, boasts faster transactions and a higher supply. Investors, seeking optimal returns and risk management, must grasp the nuanced performance of both.

Analyzing historical data provides insights into price trends, volatility, and market sentiment, guiding adjustments to the Bitcoin to Litecoin ratio. Staying updated on technological advancements, fundamental factors, and macroeconomic influences is crucial for informed decision-making aligned with specific investment goals and risk tolerance.

Strategies for Timing the Ratio Adjustment:

Setting up the Bitcoin to Litecoin ratio in a portfolio demands a nuanced grasp of market dynamics and adept adaptation to changing conditions. Effective timing strategies are crucial for capitalizing on favorable market movements, managing risk, and enhancing overall portfolio performance.

Monitoring macroeconomic indicators, regulatory developments, and investor sentiment offers insights for opportune ratio adjustments. Technical analysis, including chart analysis and indicators, aids in identifying potential trend reversals. Incorporating a systematic approach, like rebalancing based on predetermined criteria, ensures disciplined adjustments.

Considering social media sentiment guides timely adjustments. Dollar-cost averaging reduces short-term impact, promoting a stable, long-term investment approach, and empowering effective exploration of the Bitcoin to Litecoin ratio landscape.

For streamlined execution, investors can utilize user-friendly platforms like https://changenow.io/. This platform provides an efficient process for Bitcoin to Litecoin swaps, enabling easy implementation of chosen strategies.

Future Potential and Community Sentiment:

Exploring Litecoin’s future potential is vital for optimizing the Bitcoin to Litecoin ratio in a diversified portfolio. Positioned as silver to Bitcoin’s gold, Litecoin’s unique attributes, such as technological advancements like the Lightning Network, offer growth prospects, influencing the optimal ratio. Market adoption, partnerships, and real-world applications underscore Litecoin’s utility as a medium of exchange, guiding portfolio ratios. Regulatory clarity and acceptance enhance investor confidence, with monitoring ensuring informed adjustments to cryptocurrency market trends, macroeconomic conditions, and changing perceptions.

Simultaneously, community sentiment plays a crucial role in cryptocurrency investments, significantly impacting decisions on the Bitcoin to Litecoin ratio. Collective beliefs and actions of the crypto community influence market trends and digital asset value perceptions. Monitoring online forums and social media platforms provides insights into attitudes, guiding strategic portfolio adjustments. A vibrant community signals growth potential, shaping ecosystem development. Understanding investor sentiment aids informed decisions, requiring vigilance and adaptability to optimize portfolio ratios aligned with the prevailing community views.

User Experience and Feedback:

The user experience and comments on websites such as https://changenow.com are important considerations when optimizing the Bitcoin to Litecoin ratio in a diversified portfolio.io/ play a pivotal role. The ease of navigation and user feedback significantly influence decision-making. A user-friendly interface simplifies the transaction process, prioritizing intuitive design and straightforward navigation. Swift and reliable transaction execution minimizes exposure to market volatility, enhancing efficiency. Positive user experiences, as reflected in feedback, provide real-world insights into platform strengths and weaknesses. Security features, including two-factor authentication, contribute to a secure environment, fostering trust. Responsive customer support ensures a smooth and reliable experience for investors engaging in Bitcoin to Litecoin transactions, adding to the overall success of portfolio optimization.

Conclusion

In conclusion, optimizing the Bitcoin to Litecoin ratio in a diversified portfolio demands a strategic and multifaceted approach. Crucial considerations include efficiency in swaps, risk mitigation through diversification, reduced transaction costs, and market insights. Understanding Litecoin’s future potential, timing ratio adjustments, assessing community sentiment, and prioritizing a positive user experience are pivotal. Traversing these elements with diligence and adaptability positions investors to capitalize on opportunities, manage risk effectively, and achieve long-term success in cryptocurrency investments. Explore https://changenow.io/ for efficient, user-friendly Bitcoin to Litecoin swaps, aligning with these principles and enhancing portfolio management in exciting cryptocurrency investments.