Insurtech Integration: What Traditional Insurers Can Learn from Startups

In an industry known for legacy systems, slow innovation, and cautious digital adoption, insurance companies are now facing a clear wake-up call. The rise of insurtech startups, tech-driven companies offering smarter, faster, and more customer-centric services, has not only introduced new tools but also new expectations. From mobile-first onboarding to real-time underwriting, these nimble players are redefining what “good” looks like. For traditional insurers, this is no longer a trend to observe; it’s a call to evolve or fall behind. The smartest are learning from insurtechs, not just mimicking, but integrating their best traits into core operations.

Customer Experience Is the New Battleground

Gone are the days when customers tolerated clunky portals, vague policies, and endless paperwork. Insurtechs have raised the bar with intuitive mobile apps, transparent pricing, and instant quote generators. Traditional insurers are catching on, investing in UI/UX improvements and customer journey mapping to stay competitive. While big names have the advantage of brand trust, they’re increasingly partnering with insurtech firms to modernize digital touchpoints. Companies like Lemonade and Root didn’t invent customer satisfaction. They just made it faster. Now legacy providers must meet that speed, or risk becoming the Blockbuster of the financial sector.

Claims Processing Is Getting an Automation Makeover

The claims process has long been the Achilles’ heel of insurance: slow, manual, and opaque. Insurtechs turned that on its head by introducing automated claim filings, AI-driven fraud detection, and even photo-based damage assessments. Traditional insurers are now following suit, integrating machine learning tools to accelerate claims validation and reduce overhead. For example, insurers are using natural language processing to scan claim documents for inconsistencies or errors. Some are even trialing chatbots to handle first notice of loss (FNOL) steps. While human oversight remains key, automation is quickly becoming a vital co-pilot rather than a futuristic gimmick.

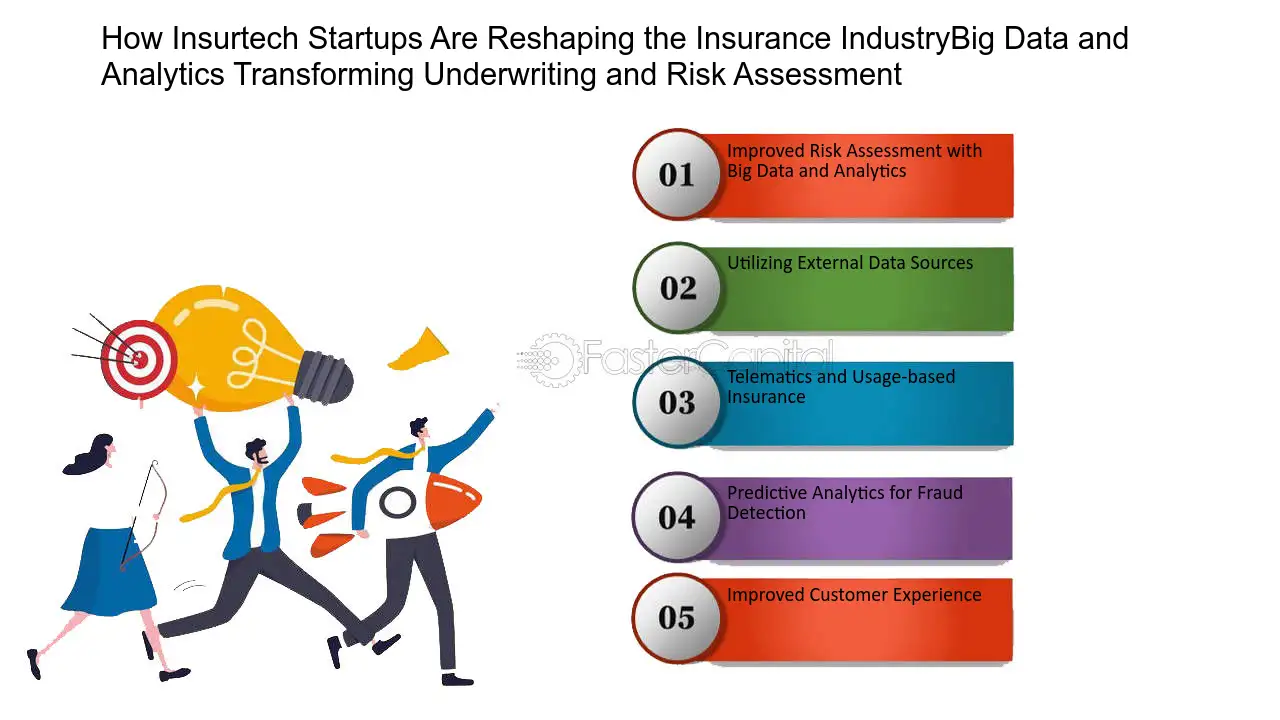

Data Is Being Used Smarter, Not Just Bigger

Insurtechs thrive on data, not just collecting it, but using it wisely. Usage-based insurance (UBI) and telematics allow for personalized pricing and more accurate risk profiles. Traditional insurers have a goldmine of data, too, but not always the tools to handle it efficiently. That’s changing. Many are now embracing advanced analytics and real-time dashboards to gain meaningful insights. In this ecosystem, security also matters. That’s why some are integrating scalable technologies like a security data lake to store and analyze logs, threat intelligence, and access data, enabling safer digital operations while improving internal decision-making.

Partnerships Are Driving Innovation

Rather than seeing insurtechs as threats, many established players are embracing them as collaborators. Strategic partnerships, rather than full acquisitions, are increasingly common. This allows insurers to test new technologies like AI underwriting or microinsurance models without fully disrupting their core systems. Munich Re, for example, has partnered with multiple insurtechs to explore digital-first risk management. These collaborations speed up innovation while preserving legacy stability. It’s no longer about building everything in-house. It’s about knowing when to integrate, when to outsource, and when to simply get out of the way.

Regulatory Mindsets Must Evolve Alongside Technology

While regulators have traditionally been cautious around tech-driven disruption, even they’re recognizing the potential of insurtech integration. Sandbox environments and innovation labs have emerged in jurisdictions like the UK, Singapore, and parts of the US, allowing insurers to pilot digital solutions with regulatory flexibility. Legacy insurers must now navigate not only evolving customer needs but also shifting compliance frameworks. This means legal teams are working more closely with product developers, risk analysts, and IT departments to ensure every rollout meets modern standards. Innovation without compliance isn’t sustainable, and that lesson is finally being taken seriously.

Culture Is the Final and Biggest Hurdle

Technology is relatively easy to adopt. Culture, less so. Many traditional insurers struggle with internal resistance, risk-aversion, and change fatigue. Yet culture is where insurtechs have always had an edge: embracing failure as learning, iteration as normal, and experimentation as essential. That mindset is seeping into older institutions, slowly but steadily. Leaders are encouraging cross-functional teams, agile workflows, and even internal “innovation units” to test ideas without layers of red tape. The biggest gains often come not from the tech itself, but from unlocking the people behind it. Without cultural alignment, even the most cutting-edge tools gather dust.